Fixing the bank crisis is the easy part

Asia Times

25 Gennaio 2009

For the third time in the post-war period, the United States banking system is insolvent. When President Barack Obama's economic advisor Paul Volcker chaired the Federal Reserve's Board of Governors in 1981, the collapse of emerging-market borrowers left the big American banks on the verge of bankruptcy. The collapse of the junk-bond market in 1990 followed by the real estate market in 1991 left the system insolvent once again.

Both times, the right medicine was to ignore the disease. Rather than mark banks' asset books to market, the Federal Reserve let them carry bad loans at face value. By dropping interest rates, the Fed provided cheap funding for the banks to earn a higher margin on their assets. As long as cash-on-cash returns were positive, the regulators could ignore the insolvency.

Today's problem is far worse than the previous two system insolvencies, to be sure. It is so large that nationalization the banking system very well might crush the credit of the United States. But with close to zero-percent funding from the Federal Reserve, American banks can acquire cheap assets that pay yields of 15%-20%. The cash flow available on non-agency mortgage bonds, credit card bonds, structured bonds backed by corporate loans, and other high-yielding assets is big enough to provide banks with positive cash flow despite mounting losses on real estate, mortgages and consumer loans.

Because the hole is so large in banks' balance sheets, plugging it is a tricky maneuver, as I will explain below. But it can be done, and the nationalization of the banking system is far from inevitable. In fact, it almost certainly would backfire.

That's the good news. The bad news is that it won't matter for the economy.

The banks aren't the problem. In fact, the banking system has been lending more during the present recession than it has in any previous recession.

Commercial and industrial loans at all commercial banks

Source

Source: Board of Governors of the Federal Reserve System.

Shaded areas indicate US recessions as determined by the National Bureau of Economic Research (NBER).

Commercial and industrial loans at US banks rose through the present recession. During the previous recession of 2001-2002, they began falling and kept falling until 2004. The banks are lending. Not only are they making loans, but they also are buying securities.

Other securities at all commercial banks

Source

Source: Board of Governors of the Federal Reserve System

Shaded areas indicate US recessions as determined by the NBER

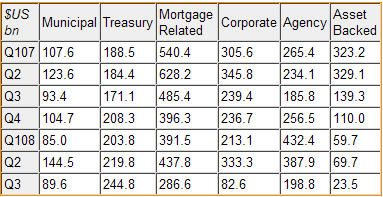

What has happened, rather, is that the market's willingness to buy credit-sensitive American bonds has collapsed. Between the first quarter of 2007 and the third quarter of 2008, mortgage-backed securities issuance dropped by roughly half, corporate bond issuance by three-quarters, and asset-backed issuance by more than nine-tenths.

Prior to the credit crisis, the US imported a trillion dollars a year of capital to finance the housing bubble and related consumer credit expansion, as well as the application of corporate leverage through leveraged buyouts and speculative-grade bond issuance. Global demand for such securities (and the structured vehicles into which they were packaged) collapsed after the subprime collapse of mid-2007. That is not the fault of the American banking system, but a violent allergic reaction against American risk on the part of the world market.

Hedge funds, whose assets have shrunk violently from US$1.9 trillion in the middle of 2008 to only $1.4 trillion at year-end, have had to sell enormous quantities of securities. Banks used to allow hedge funds to lever such assets many times over. They no longer are willing to provide leverage, and regulators wouldn't allow them to if they wanted to.

In fact, the collapse of these markets provides the solution to the American banking crisis. Forced selling by hedge funds has cheapened the price of subprime mortgage bonds, for example, to the point that they are highly attractive. AAA-rated bonds backed by subprime mortgages issued in 2007, for example, start to lose principal only after losses reach 35%. Losses almost certainly will exceed that number - but will they exceed 50%, or 60%? That is extremely unlikely.

Yet bonds with a 5% coupon are selling at a dollar price of 35 cents, for a yield of well over 14%. Even with an extremely high loss rate, the yield should be in excess of 10%. Financed at zero percent, with an 8% capital coverage ratio, the rate of return on holding such instruments is enormous. The same is true of collateralized loan obligations backed by high-quality corporate debt, credit card bonds, and various other asset classes.

In effect, I argued in the Inner Workings blog on this site, a trillion dollars' worth of hedge fund equity will be wiped out through forced sales. That leaves several trillion dollars worth of assets (a levered multiple of the lost equity) trading at well below fair value, with no available buyers. Levered investors no longer can obtain leverage.

In effect, a trillion dollars of hedge fund equity will be transferred to the banking system. Banks will buy cheap assets with even cheaper leverage provided by the Federal Reserve, and their cash-on-cash returns will turn positive. Only one other thing is required to end the banking crisis, and that is to lie outright about the true state of banks' books.

That, in essence, is what the Group of Thirty, a private association of economists, bankers and public officials, proposed on January 15 in a study of bank regulation headed by Paul Volcker. Eliminating mark-to-market accounting, that is, allowing banks to carry devalued assets at par as long as they continue to pay interest, is the most important of its recommendations.

It is writedowns of asset prices, rather than cash flow, that have crushed bank profits during the past two years. As I showed in my Inner Workings blog, the collapse of bank stocks followed the price decline of the kind of assets they own. Banks will have huge losses to cash flow as assets stop paying, but they also have the ability to add sufficient cash flows to stay in the black on a cash flow basis.

In fact, the collapse of asset prices helps the banks. As asset prices cheapen, banks can add cash flows at lower cost. In that sense, it has to get worse before it gets better. The danger in such a strategy is that confidence in the banks might collapse and impinge their capacity to borrow. Government guarantees of bank debts as well as ring-fencing of assets, though, have kept the borrowing costs of the banks manageable even while their stock prices have tumbled.

The future of the banks is a miserable, penurious existence in which shareholders live on the brink of annihilation, high returns on bargain-priced assets barely replace lost cash flows due to consumer and corporate defaults, and government regulators look over bankers' shoulders all day long. Banks will return to the black-box model, carrying illiquid assets on their books at par, as they did during the 1980s and 1990s. They will resemble a regulated public utility more than the buccaneers of the 1990s and 2000s. But they will survive.

Nationalization as an alternative would be a catastrophe.

The prospect that Great Britain might nationalize its banks has already raised the specter of a British bankruptcy. It costs as much to buy insurance against a British default today, at LIBOR +150 basis points, as it did to insure Brazilian paper last spring. The mere rumor of American bank nationalization has pushed the cost of insuring against American default to 75 basis points (a basis point is a hundredth of a percentage point). That's what it cost to insure against Brazilian default in May 2007.

When governments take over banks, they are saying in effect that the asset book is so damaged that the bank will never be able to make good on its liabilities. The government then takes responsibility for the liabilities. In the case of Iceland, whose banks mushroomed to several times the size of the national economy, the liabilities of the banks sank the credit of the government. British pundits are now writing about Reykjavik on the Thames, as Britain's Prime Minister Gordon Brown takes majority shares in some banks.

The US is already borrowing unprecedented amounts in global capital markets. As I wrote in this publication last November, a Treasury borrowing requirement well in excess of $1 trillion puts enormous strains on global markets (see The black hole in financial markets, Asia Times Online, November 22, 2008).

If the Treasury has to take on an additional $2 trillion of debt as the cost of bank nationalization, the hairline cracks in the credit of the US Treasury could widen into something very dangerous. During the past few days, term Treasury yields backed up violently, from just over 2% on December 31 to 2.65% at the end of last week for the 10-year Treasury. This occurred while risk aversion spiked. That is an ominous sign.

During previous episodes of risk aversion, investors bought Treasuries as a safe haven. Now the threat is that the Treasury will have to borrow trillions of dollars to buy the banking system. If Treasuries lose their safe-haven status, the entire financial system is in extreme danger. That is not an exaggeration.

An additional problem is the ballooning of the Federal Reserve's balance sheet by $1.4 trillion to include mortgage-backed securities, commercial paper, and other risky securities. There is not a great deal of difference between the Fed's balance sheet and Citigroup's. If Citigroup is liquidated, the market would wonder whether the Federal Reserve itself was viable. That is a very dangerous question to leave open.

In the great scheme of things, it does not matter for the world financial system if all the hedge funds in the world go out of business. Wealthy investors (and some pension funds and life insurance companies) would lose their equity. If the banks collapse, the world economy goes into depression, and if the weight of bank liabilities sinks the credit of national governments, the depression will be worse than that of the 1930s. That is why it is reassuring that Paul Volcker is close to President Barack Obama. He has done this before, and knows how to do it again.

Stabilizing the banks, though, is a necessary but not sufficient condition for economic recovery. There is no reason to believe that the banks do not wish to lend to consumers or business; as noted, they never stopped lending during the present downturn. The bigger problem is that American consumers do not wish to borrow. What John Maynard Keynes called the marginal propensity to save shifted towards the 1.0 mark, as Americans realized that they were trillions of dollars short of funding their collective retirement. The national illusion that capital gains would substitute for savings has disappeared, and Americans are now attempting to save as much as they can. If they all try to save at the same time by shutting down expenditures, of course, the economy will collapse.

As Francesco Sisci and I wrote in this space last November: "No recovery is possible unless American households can save, and they cannot save in an economic contraction when incomes spiral downwards. To save, Americans must sell goods and services to someone else, and a glance at the globe makes clear who that must be: nearly half the world's population, and most of the world's capacity for economic growth, is concentrated in China and the Pacific Littoral." (see US's road to recovery runs through Beijing, Asia Times Online, November 15, 2008).

America must seek a global solution to its economic problems. Defusing the bank crisis would buy time to put a real solution in place.

by David P Goldman, head of debt research at Bank of America's securities branch 2002-2005 and a member of its fixed income executive committee.

Source > Asia Times | Jan 24