Wall Street rallies to aid Lehman

Telegraph.co.uk

20 Marzo 2008

Wall Street's leading investment banks have rallied around ailing rival Lehman Brothers after the Federal Reserve Bank of New York urged them to support the institution in order to try and preserve financial stability.

# News from the banking and financial services sector

It is understood the New York Fed contacted key executives at a number of leading banks, including Goldman Sachs, Citigroup and Morgan Stanley, to discuss Lehman's situation over the weekend.

By yesterday morning, the banks' prime brokerage departments - which service hedge fund clients - were under strict instructions not to do or say anything in the market that could damage Lehman.

under strict instructions not to do or say anything in the market that could damage Lehman.

The intervention is important because Wall Street fears a repeat of the events which led to the weekend's rescue of Bear Stearns. The bank was fatally damaged when hedge funds closed out their positions, demanding immediate repayment of the cash.

One American banker said: "[We heard] from the top, 'Do not encourage calls to Lehman clients. We want to run that up the flagpole. We don't want another run on a bank.' "

As a result, it is believed that bankers were told not to solicit Lehman's clients for business or to give the impression the bank is uncreditworthy.

Lehman's business model is closest to that of Bear Stearns, and there has been considerable speculation surrounding the state of its balance sheet. A spokesman from Lehman Bros declined to comment. The other banks involved in the calls also declined to comment.

A spokesman for the New York Fed said: "We never talk about private discussions between the Federal Reserve and commercial banks."

According to a source close to one of the banks, the Wall Street club remains very supportive of Lehman and is wary of doing something that might harm the bank's financial position.

Lehman chief executive Dick Fuld yesterday moved to calm concerns in the market, saying that the Federal Reserve's decision on Sunday to make secured loans to investment banks should ease fears. He said that from his perspective the creation of a liquidity facility for primary dealers "takes the liquidity issue for the entire industry off the table".

In addition to the liquidity facility, the Fed also reduced the discount rate at which banks borrow money from 3.5pc to 3.25pc, ahead of today's Federal Open Markets Committee meeting at which the main base rate is expected to be cut by at least 0.75pc.

In spite of his reassurances, Lehman's shares, which are now trading at their lowest level since 2003, fell as much as 46pc at one stage to recover to close down $8.82, or 22.5pc, at $30.44.

Lehman is due to report first-quarter results this morning during which it is expected to attempt to allay investor concerns.

Other banks to be hit included Citi, whose shares were off 9pc at one stage, and Merrill, which fell as much as 14pc.

Respected banking analyst Meredith Whitney, of Oppenheimer & Co, predicted that shares in banks and other financial institutions would fall as much as 50pc in the wake of Bear's rock-bottom sale to JP Morgan Chase.

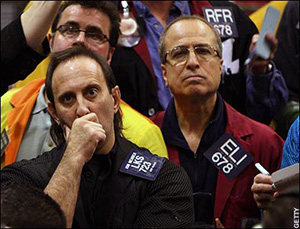

Volatile trading was endemic across financial markets, with the New York Stock Exchange seeking to calm its floor traders by invoking a little-used rule that suspends the need to disseminate price indications and to obtain approval for prices prior to opening.

US Treasury Secretary Henry "Hank" Paulson said he supported the Fed's actions over the weekend.

By Helen Power

Source > Telegraph.co.uk