CDS Pricing in Increasing Treasury Default Risk

Naked Capitalism

03 Novembre 2008

We have noted that Treasuries (and the dollar) are the remaining bubbles, although some doubts are starting to surface on the Treasury front. Paul Amery at Prudent Bear gives a good recap:

The tectonic plates underlying the whole superstructure of debt have started to shift.

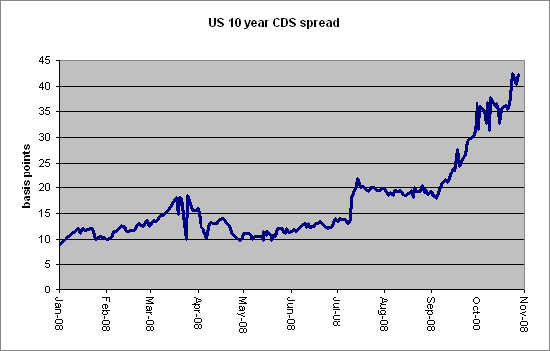

On the surface nothing remarkable is happening – the 30 year US Treasury bond yield recently hit an all-time low of 3.88%, as investors sought a safe haven during equity market turbulence. Yet while nominal bond yields have declined, the credit risk component of US Treasuries has been on an increasing trend since last year. According to data provided by CMA DataVision, the credit specialists, the 10-year credit default swap spread – a form of insurance contract against issuer default – has risen steadily - from 1.6 basis points (0.016%) in July 2007, to 16 basis points in March 2008, to 30 basis points in September, to over 40 basis points on October 27 – see the chart below for the spread history so far this year. In other words the cost of insuring against a US government default has risen by 25 times in little over a year. Similar trends have been evident in the UK and German government bond markets.

This has perplexed, and even amused, some market observers. How, they ask, could a private sector contract against default be expected to pay out in the case of a US government default – which would be the equivalent of a nuclear explosion in the financial markets? So what’s the point of buying such a contract?

Moreover, how could the US government ever renege on its debts? After all, it supplies the world’s reserve currency, and the Federal Reserve Chairman reminded us a few years ago of the US authorities’ ability to print money in unlimited quantities. Any “default” would at least be through the time-tested mechanism of inflation and currency devaluation, according to this view.

On the other hand a longer-term examination of debt markets reminds us that, throughout human history, regular default is the rule than the exception. And while sovereign defaults on external, foreign-currency debt are most common, Carmen Reinhart and Kenneth Rogoff demonstrated in a paper released earlier this year that defaults on domestic debt have happened far more often than might have been expected, particularly in times of severe economic duress.

In both the US and UK, budget deficits are poised to explode....the really big impact is coming from the rescue packages being thrown at the financial sector. Morgan Stanley recently estimated that the 2009 fiscal deficit in the US would reach 12.5%, over double the previous record of 6%, set in 1983...

When measured as a percentage of GDP, the US national debt is expected to pass 70% next year, which, though much higher than recent years, is still short of the record 122% registered in 1946, at the end of the Second World War. Some observers point to this comparison as an argument for the sustainability of the current position.

Yet others argue that government debt must be seen in the context of, and as part of, the overall debt burden on the economy. With the US private debt to GDP ratio at levels never seen before – close to 300%, according to Steve Keen, the Australian economist – the question is surely whether the whole debt pyramid can avoid crashing down via a violent and uncontrollable chain of defaults, dragging the government bond market down with it. If this seems far-fetched, it helps to remember that the Latin root of the word credit comes from credere – to believe, but also to trust. For large sections of the private sector bond market, it is precisely that trust which has disappeared over the last year and a half. To suggest that such “credit revulsion”, to use an old term, might spread to governments’ debt obligations is surely not beyond the realms of possibility

Signs of strain in the US Treasury market are already there, despite the current low yields. Recent auctions have shown poor bid-to-cover ratios, and long tails (the difference between the average accepted yield, and highest yield), both signs of shallow demand. Delivery failures in the secondary market have also hit record levels, a sign of poor liquidity. Market observers should keep a close eye on the progress of future auctions, particularly as the issuance schedule picks up.

How can investors take cover if concerns over government solvency spread? For the early part of any credit-related decline in bond prices, there are obvious hedges, such as credit default swaps, short Treasury bond futures positions and inverse Treasury ETFs. But ultimately a US debt default would have cataclysmic consequences for the financial economy, bankrupting the entire system. So the ultimate safe haven is in the precious metals, which would rapidly regain monetary status in such a scenario.

Source > Naked capitalism | nov 02